The Uganda Microfinance Regulatory Authority (UMRA) has urged the public to avoid excessive borrowing from online money lenders due to a rise in harassment complaints by loan sharks.

UMRA’s Compliance Officer, Benon Mugambe, highlighted the growing number of complaints from borrowers unable to repay loans, leading to mistreatment.

He made the remarks during the launch of a partnership between Airtel Uganda and Mogo Uganda, an asset financing firm offering smartphones on instalment plans.

Mugambe advised Ugandans to borrow responsibly to avoid falling into debt traps.

The caution comes as the two companies’ partner in a move to address the persistent “device divide”, the economic barrier that prevents millions from participating in Uganda’s digital economy.

This partnership will enable customers to own brand-new smartphones from leading brands Tecno, Infinix, and Itel with a simple and affordable financing plan.

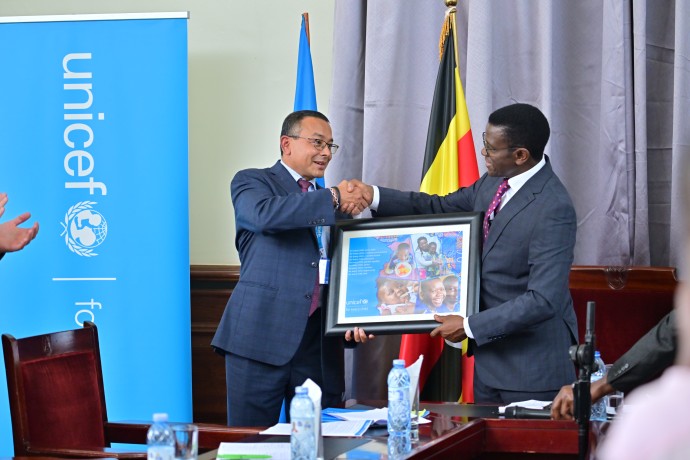

Airtel Managing Director Soumendaru Sahu noted that the partnership aims to make smartphones more affordable, promoting digital and financial inclusion, which contributes to long-term economic growth.

Speaking at the launch, Sahu said that this an innovative smartphone financing initiative aimed at making quality smartphones more accessible and affordable to Ugandans across the country.

“In today’s digital world, a smartphone is a lifeline to opportunity. Through this partnership, we are making digital empowerment tangible and achievable for more Ugandans than ever before. And as the number one network of choice, Airtel Uganda is committed to pairing affordable devices with strong, safe, and reliable connectivity.”-Sahu said

Soumendra added “This initiative aligns with Airtel Uganda’s continued efforts to expand network coverage and digital safety. Just recently, Airtel rolled out new network sites across the country and launched Uganda’s first AI-powered Spam Alert Service. A proactive tool that protects users from scams, fraud, and digital manipulation.”

Japhet Aritho, managing Director Airtel Money explains under this partnership Airtel money platform offers a platform for Ugandans to access credit facilities and allow convenient payments for the devices that their social and economic well being.

“Customers can walk into any MOGO Uganda retailer or select Airtel Service Centers, present their National ID, choose a smartphone of their choice, make a small initial deposit, and walk away with the device in just minutes and start making payments via the airtel wallet”-Aritho

He said that in addition, every participant will receive 3GB of FREE Airtel data every month for three consecutive months, allowing them to unlock immediate value from their new devices.

Modestas Sudnius, CEO of Eleving Group (MOGO’s parent company), emphasized the group’s pan-African vision for economic mobility through smart financing saying “We’ve invested 30 million euros in Uganda, and with the launch of smartphone loans, we aim to double our business and explore expansion into other markets. Uganda’s potential is vast, driven by a young, rapidly developing population where many still lack access to smartphones. Access to a smartphone equals access to global information and technology, empowering every Ugandan and accelerating the country’s development.

The program is expected to empower over 360,000 Ugandans annually, with far-reaching benefits from students accessing online learning, to farmers checking market prices, to entrepreneurs running businesses via mobile platforms.