The government has said it is implementing vigorous reforms in the tax administration and rationalization of tax exemptions to reduce revenue losses and improve revenue mobilization in the financial year 2023/2024.

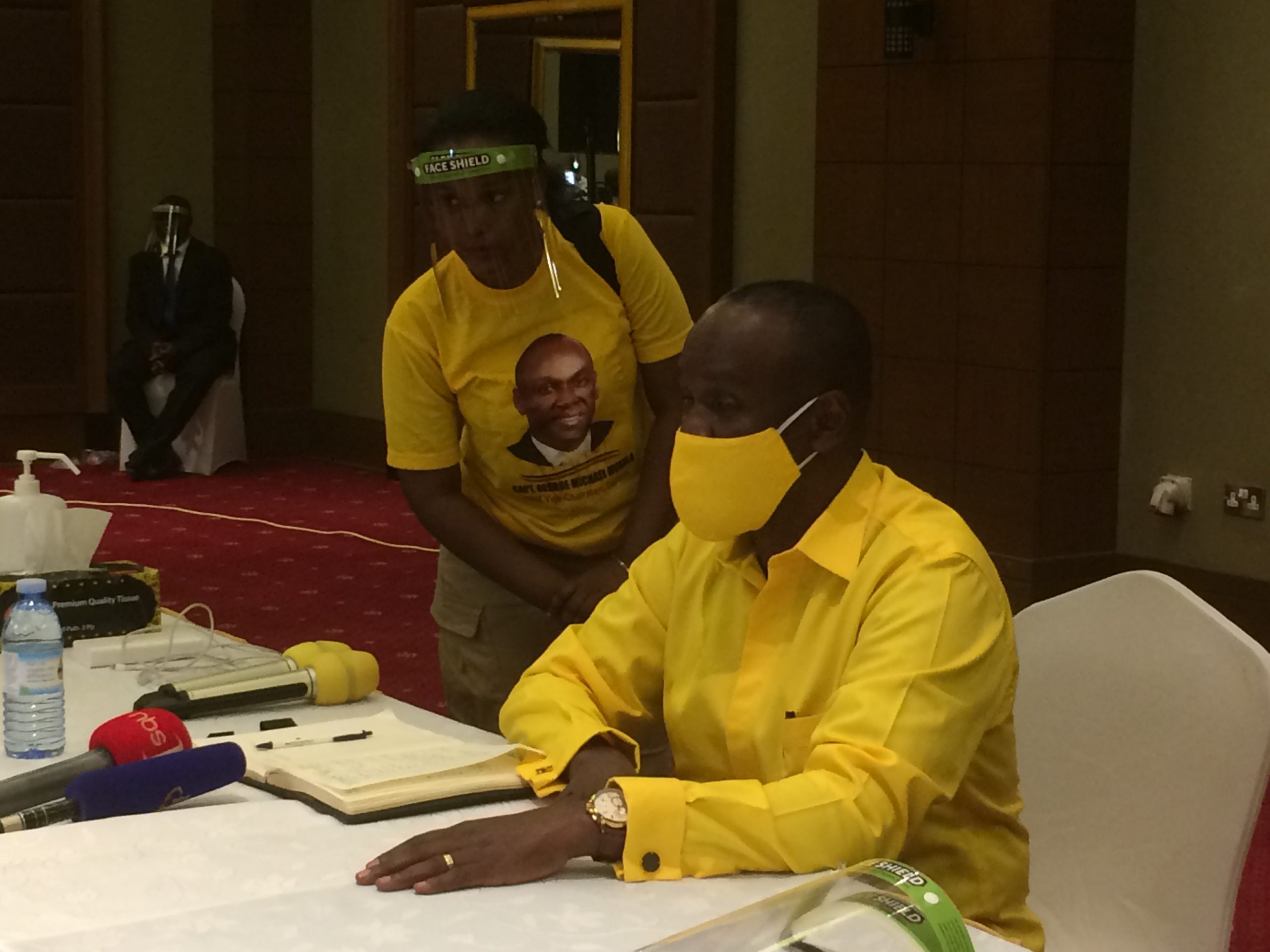

It was communicated by Matia Kasaija, the Minister of Finance, Planning, and Economic Development on Thursday afternoon during the budget reading ceremony held at Kololo Independent Grounds in Kampala.

The theme for this year’s national budget is, “Full Monetization of Uganda’s Economy through Commercial Agriculture, Industrialization, Expanding and Broadening Services, Digital Transformation and Market Access.”

Kasaija says in the next financial year, the government has prioritized the use of information, communication, and technology – ICT to fight tax evasion and rationalize tax exemptions to improve their effectiveness and reduce revenue leakage.

Strengthening the Taxpayer Register Expansion Programme framework, a collaboration between tax boy Uganda Revenue Authority – URA, Uganda Registration Services Bureau – URSB, Kampala Capital City Authority – KCCA, and the Ministry of Local Government in revenue collection.

He said the Government has put up stringent requirements in the application of new tax exemptions, and assesses the costs and benefits of all tax exemptions to ensure adherence as enshrined in the Excise Duty Act Amendments, Tax Procedures Code Act Amendments, Income Tax, and Value Added Tax Act laws recently amended by Parliament.

Kasaija pointed out that the Government through the line Ministries, Departments, and Agencies strives to improve taxpayer awareness and help the citizenry to know their rights and obligations awareness interventions across regions, sectors, and gender to improve the tax system and ensure fairness.

Further, he reiterated that the tax body will intensify surveillance of wider coverage of porous borders to curb smuggling through extensive intelligence-focused operations supported by the use of drones and body cameras to deter illicit financial transactions where Uganda loses an estimated 300-500 billion annually in revenue.

Overall, the objective of the tax administration reforms and review of tax exemption is to improve revenue collection to between 16 and 18% of Gross Domestic Product – GDP over the next five years from about 13.5% of the GDP currently.

For Financial Year 2023/2024, the resource envelope or total expenditure will be 52.7 trillion. Wages and Salaries will amount to 7.3 trillion and Non-Wage Recurrent Expenditure is 13.5 trillion. Domestic Revenues amount to 29.7 trillion of which 27.4 trillion will be tax revenue and 2.3 trillion will be Non-Tax Revenue.

Domestic borrowing amounts to 3.2 trillion, budget support accounts for 2.8 trillion, and external financing for projects amounts to 8.3 trillion; of which 3.01 trillion is from grants, and 5.3 trillion is from loans.

Appropriation in Aid, collected by Local Governments amounts to 287 billion; Domestic Debt Refinancing will amount to 8.4 trillion; and other financing 229 billion while the development expenditure amounts to 6.1 trillion and external project support financing is 8.3 trillion