Deputy Speaker Tayebwa advises Parliamentary SACCO to start a bank*

The Deputy Speaker of Parliament, Thomas Tayebwa, has advised the Parliamentary Saving and Credit Cooperative Organisation’s leaders to start a bank to serve the wider public better.

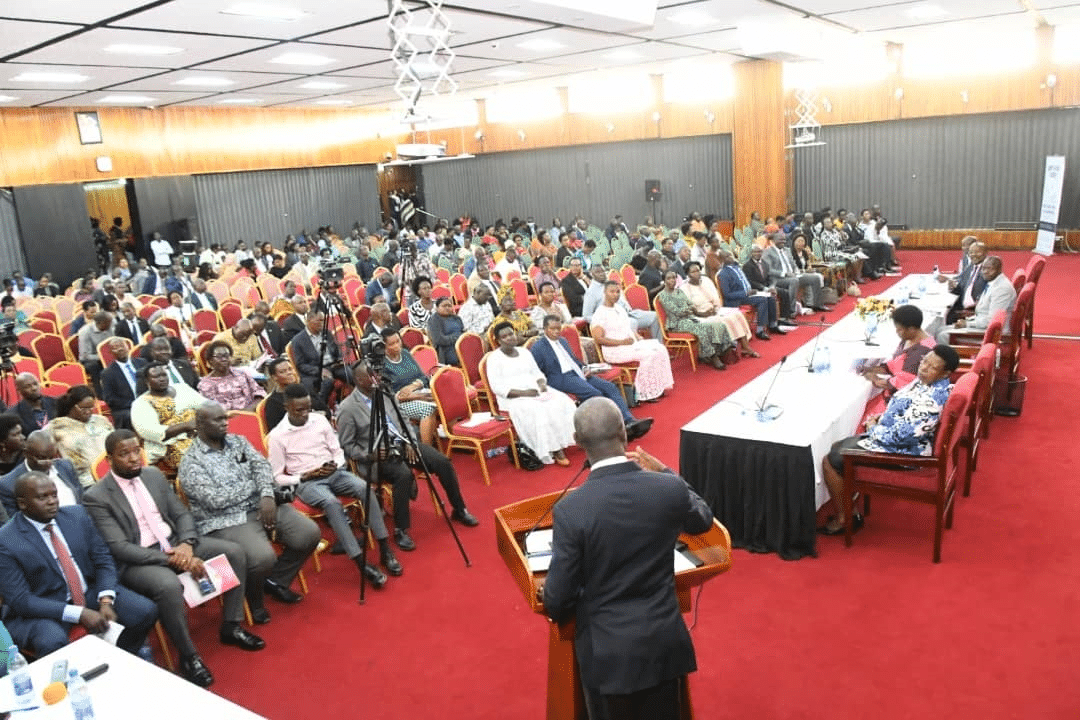

Mr Tayebwa who was presiding over the 19th Annual General Meeting of the members of SACCO on Friday, said the bank would bring more money for the benefit of the members on account of a solid assets base.

“Looking at this SACCO with assets of around Shs67 billion, this is strong and I think next year we need to look at starting a commercial bank. I have seen some of the banks where you are fixing money they don’t have that money. Why can’t we make it and then each one of us shall have a sense of ownership?” Mr Tayebwa advised.

The deputy speaker’s reaction came after the SACCO Board Chairperson, Hon. Migadde Robert Ndugwa, detailed the growth of the assets which stood at Shs67b as of June 30.

The Sacco chief also explained the general growth of the 21-year-old- SACCO, revealing that the audited books of accounts indicate that by June 30, the facility grew by Shs18.21b from Shs29.36m to Shs47.57b by the close of the financial year.

The SACCO has also recorded an increase in the loan uptake from Shs25.34b to Shs33.44b with Pamela Kamugo, Woman MP Budaka District awarded as the best borrower while Tororo South MP, Fredrick Angura scooped the best saver award.

“Also we have grown the total assets from Shs47.34b to Shs67.7b and I think credit goes to you MPs, the former members, and staff,” said Hon. Migadde.

The Deputy Speaker applauded the SACCO management for the job well done and its strategic decision to invest in long-term ventures like treasury bonds because they return more income on interest.

A fixed deposit is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date.

Mr Tayebwa reiterated that: “I know how the markets have been performing and I am glad you are opening up to long-term investments and it is one thing which I have been telling you because when I see you investing in fixed deposits and yet these people are putting money in long term treasury bonds, then I was asking myself, what are you doing? “

Disclosing that most of his savings on emoluments from parliament are invested in the Parliamentary SACCO, the Deputy Speaker encouraged legislators to save a significant percentage of their monthly income to cater for financial shocks in the future, adding that this was the purpose of the Sacco.

He also explained that because legislators spend a lot of money on their re-election campaigns, they need to mitigate the financial risks associated with political pressures.

“I have seen in Parliament the issue of saving culture is bad because of the pressure we have in our constituencies. You see someone who is earning almost 10 percent of your salary is growing and you are not growing,” he said, adding that “I think it is a problem of many Ugandans who spend much more than they earn. The issue is all about us managing our appetite for risks. Let’s save at least 20 percent of our earnings and secure the future.”

“The Indians save before eating, Africans we eat and then after we save,” the deputy speaker emphasized.

Hon. Migadde told the General Assembly that SACCO has positioned itself on an international level by subscribing to the African Confederation of Cooperative Savings and Credit Association (ACCOSCA), an opportunity that has opened gates for more training in financial management.

“At the continental level, the SACCO is now an associate member of ACCOSCA. This year our SACCO was represented in Zimbabwe and Botswana where we received training in SACCO management,” Hon.Migadde said.

“Also we received a delegation from the National Assembly of Zambia SACCO who were here to benchmark on how our SACCO operates.”

The SACCO boss also revealed that the facility is already planning on embarking on Corporate Social Responsibility (CSR) with the hope of identifying and supporting some needy families across the country.

The SACCO’s Annual General meeting passed a resolution to write off up to Shs421.3m loans for former members who have since passed away.