By Solomon Lubambula

Market analysts are expressing optimism that Uganda will see increased public participation in capital markets following intensified investor education initiatives led by sector regulators.

This renewed hope comes after the Capital Markets Authority (CMA), in partnership with the Uganda Financial Literacy Association (UFLA), conducted a Financial Literacy Training of Trainers workshop for the Northern Uganda region.

The session brought together over 70 trainers from districts such as Pader, Nwoya, Omoro, Agago, Kitgum, Arua, Pakwach, and Gulu, marking a significant step in broadening financial awareness across the region.

The training forms part of CMA’s wider strategy to equip ordinary Ugandans with practical skills in personal finance, saving, investment, and safely navigating the country’s capital markets.

Josephine Ossiya, CMA Executive Officer emphasized that investor education is foundational to meaningful market participation.

“when Ugandans understand how to identify licensed players, evaluate investment opportunities, and avoid investment scams, they will be in a better position to build long-term financial security”-Ossiya noted.

Uganda’s capital markets currently offer a variety of regulated investment products, including Collective Investment Schemes like unit trusts, government and corporate bonds, equities listed on the Uganda Securities Exchange, as well as licensed investment advisors and fund managers who support informed decision-making.

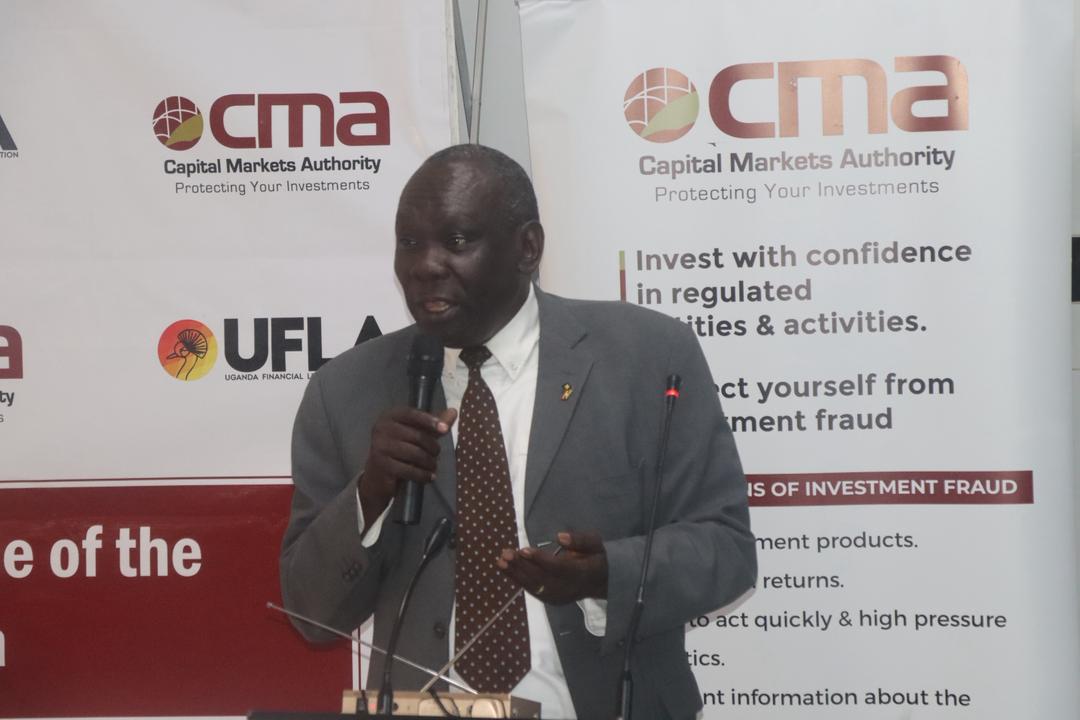

Underscoring the importance of the outreach, Daniel Ayebare the Uganda Financial Literacy Association Chairperson said that Financial literacy is not a privilege for a few but a necessity for all.

“As UFLA, we are scaling into various regions across the country and this demonstrates our commitment to ensuring that every Ugandan can participate confidently in Uganda’s economic transformation”-Ayebare said

Ayebare added that all UFLA training materials now include detailed explanations of capital markets products and the regulatory role of CMA.

Representing the government, Gulu City Resident City Commissioner Ambrose Onoria commended CMA and UFLA for promoting financial education at the grassroots level.

He said empowering trainers in Northern Uganda creates a multiplier effect that will extend financial knowledge to households, schools, SACCOs, youth groups, and business owners, aligning with national goals of inclusive development and citizen empowerment.

The Training of Trainers program provided participants with tools and curriculum covering budgeting, saving, and investment options such as Collective Investment Schemes, shares, and government bonds.

This initiative builds on previously established regional financial literacy chapters in Central, Western, and Eastern Uganda, demonstrating continued collaboration between UFLA and CMA to deepen financial knowledge nationwide.